Thursday October 27, 2011

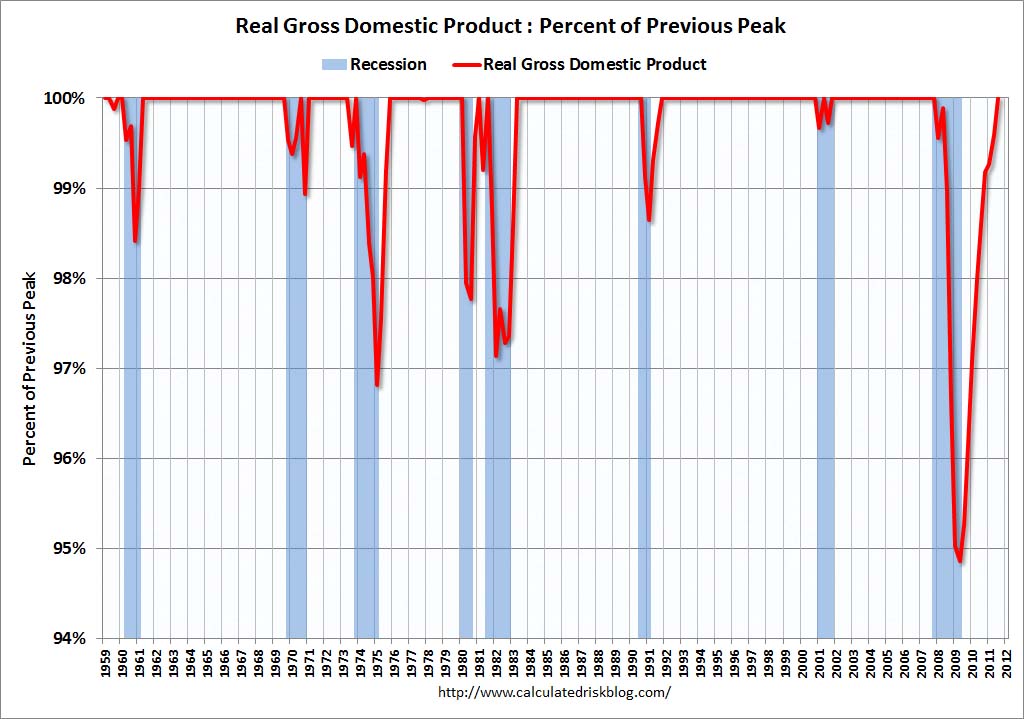

After 15 quarters the US economy has finally regained the ground it lost — at least on a real GDP basis. We've still got a ways to go before we regain all the jobs we lost.

Thursday October 20, 2011

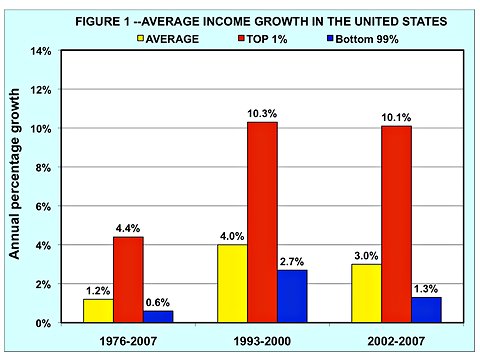

Income inequality as a hazard to sustained growth.

This all suggests that inequality seems to matter in itself and is not just proxying for other factors. Inequality also preserves its significance more systematically across different samples and definitions of growth spells than the other variables do. Of course, inequality is not the only thing that matters but, from our analysis, it clearly belongs on the list of well-established growth factors such as the quality of political institutions or trade openness.

Wednesday October 19, 2011

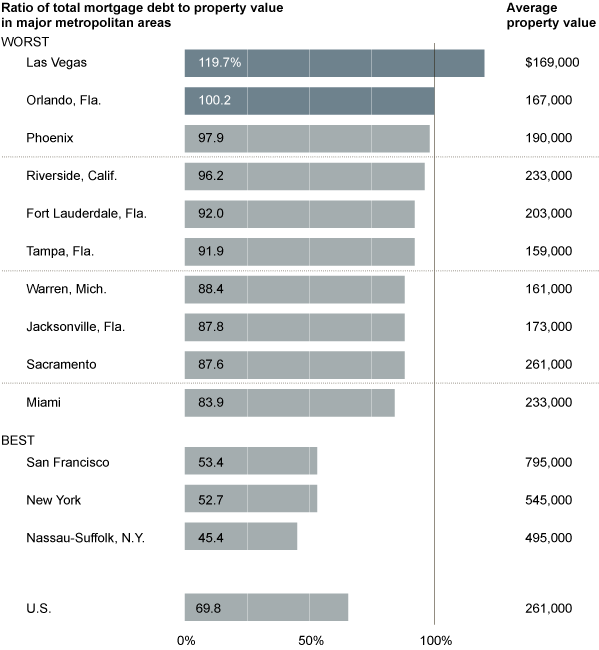

Total outstanding mortgage debt exceeds total property value in Las Vegas and Orlando.

Remember that roughly 1/3 of households nationwide have no mortgage on their house at all. So in these two towns the outstanding mortgage debt on the subset of homes that have mortgages adds up to more than the total value of all homes including the ones without mortgages.

Monday October 10, 2011

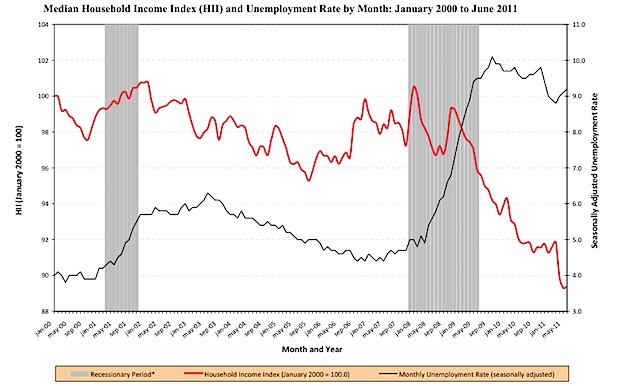

Median household income continued to fall after the end of the recession.

The full 9.8 percent drop in income from the start of the recession to this June — the most recent month in the study — appears to be the largest in several decades, according to other Census Bureau data.

Note: Felix Salmon was the first I saw to dig this image out of the report the New York Times referenced.

Sunday October 9, 2011

Michael Lewis on money as a window into culture.

I wasn't a huge fan of all the pieces in Michael Lewis' Vanity Fair series (which make up his new book Boomerang); some were interesting. But his one hour interview on Charlie Rose earlier this week is just fantastic. He's never really talking about finance or money per se, he's talking about how people respond individually and collectively to the evolving economic environment that they inhabit. I wish this was a couple of hours longer.

Friday October 7, 2011

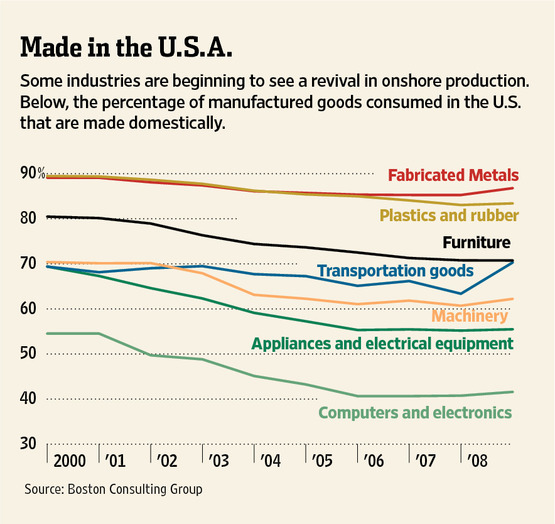

Among the forces: those ever-rising costs in China; more flexibility from some U.S. unions, resulting in fewer work rules and lower labor costs; more subsidies from some state governments; far higher productivity in the U.S.; and pressure from retailers to shorten turnaround time and cut inventories, prompting more manufacturers to abandon long supply chains to China.

[ via ]

Wednesday October 5, 2011

[ via ]

Tuesday October 4, 2011

Income growth for the top 1% and bottom 99% of income recipients.