Wednesday October 22, 2014

New mortgage rules to subsidize housing.

From Matt Yglesias:

The FHFA is going to be less of a tight-ass in a number of regards, essentially upping the level of subsidy that is provided to mortgage lenders. This will make it cheaper for some wannabe home buyers to buy homes, it will increase the value of some existing home owners' houses, and it will generate plenty of profit-seeking opportunities for realtors and banks.

and...

Unfortunately, it's also a proposition that exacerbates and entrenches everything that's wrong with the past generation of housing policy. There are two real ways to make houses more affordable. One is rising wages, and the other is greater abundance of housing supply. Tinkering with credit policy offers a short-term boost, but doesn't do anything to address the underlying issues.

This policy isn't about housing affordability or even (to my mind) access to credit. It's about stimulating the economy by manufacturing more buyers for an expensive durable good (a new house) without having to improve their actual financial standing. More jobs and more income from those jobs is a better course.

Tuesday September 23, 2014

if wages rise and people get to buy nicer houses, that's great. But if houses don't become cheaper and wages don't rise, what is actually achieved by making it easier for people to go into debt to buy them?

I think the answer to that question is that we're trying to juice the economy by incentivizing debt-financed purchases of cars and homes with the hope that the increased economic activity somehow finds its way into household income somewhere down the line. It seems like a pretty desperate plan.

Wednesday September 10, 2014

Accordingly, getting out of a Liquidity Trap with monetary policy playing the lead role necessarily involves a Dornbuschian sequence of rational overshooting: The Fed must drive up Wall Street prices, which move quickly, so as to get to Main Street prices that move up slowly, most importantly, wages.

This sequencing implies that Wall Street's prices axiomatically will, in the short run, "overshoot" their long-term fair value, as the Fed appropriately and credibly commits to staying at the ZLB, until paper wealth creation endogenously deleverages private sector balance sheets sufficiently to restore animal-spirited risk taking on Main Street.

This sequencing implies that Wall Street prices must become very rich relative to Main Street prices in order to achieve so-called escape velocity from the Liquidity Trap. At the transition point, Wall Street prices will be rationally "overvalued" relative to their long-term "fair value."

It still sounds like a trickle-down policy to me. And in this formulation it seems like wealthy asset holders get to participate in both the Wall Street recovery and the Main Street recovery while people dependent on labor income participate primarily in the latter and with a substantial (and personally risky) lag. McCulley's point, of course, is that this is not ideal, it's just the nature of the system we have built. Better political functioning could potentially decrease Wall Street's relative early outperformance and decrease the lag in the Main Street recovery.

[ via ]

Tuesday June 17, 2014

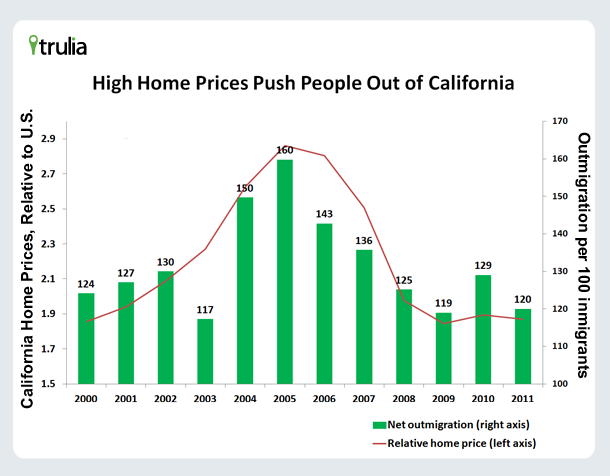

High home prices in California correlate with outmigration.

Once again, high and rising home prices are not an unambiguous good. In this case it appears the drawbacks may include the loss of middle and low income households.

Thursday April 24, 2014

Rising home prices are contributing less to GDP growth

We think it is officially time to stop cheering for higher house prices. They aren't having much of an impact on the economy anyway, and the resulting higher rents are hurting many.

Wednesday April 16, 2014

Housing Costs in San Francisco (and elsewhere)

Zoning restrictions are a tool of the oligarchy, effectively. I'm only one-fourth kidding. But they are; they are a means by which owners of capital extract an outsized share of the surplus generated by job creation.

Friday January 31, 2014

Improvements to CPI Measured Rents.

The improvement I'm suggesting is to account for the nominal rigidity of rents by looking at current market prices instead of average prices. The current practice is to survey households about their current rent expenditures, but most of these expenditures are based on leases that reflect prices which are set in the past. This is kind of (though obviously not entirely) like looking at changes in average household mortgage payments to gauge current housing market prices. A measurement based on market rents, in contrast, would reflect the prevailing market rents that are charged, and would therefore better reflect current housing market conditions.

We don't gather food price statistics by asking people what they paid for the goods in their pantry; we go look at what those goods are selling for on the market today. Seems weird that we don't do the same for rent prices.

Thursday December 19, 2013

If you haven't yet read this well-reasoned critique of the CAPE stock market valuation metric, you should.

The Shiller CAPE, as constructed by its proponents, utilizes inconsistent data. In this piece, I'm going to explain the inconsistency in rigorous accounting detail, and then share the results of a modified version of CAPE that eliminates it. I'm also going to illustrate the distortion that changes in dividend payout ratios create for CAPE.

Wednesday December 11, 2013

Trulia's Jed Kolko on the Housing Market in 2014.

Tuesday December 10, 2013

More and more renters are cost-burdened.

"In 1960, about one in four renters paid more than 30 percent of income for housing. Today, one in two are cost burdened," according to the study, America's Rental Housing.

"Cost-burdened" means you're paying more than 30 percent of income for housing and "severely cost-burdened" means you're paying more than half. "By 2011, 28 percent of renters paid more than half their incomes for housing, bringing the number with severe cost burdens up by 2.5 million in just four years, to 11.3 million," according to the Harvard study, which was conducted with partial funding from the MacArthur Foundation.

See our statistics on rent as a fraction of income.

Friday November 8, 2013

Well, there's a lot of evidence that fewer people are living in old-style, middle-class neighborhoods. You see this in American cities. Manhattan is far wealthier than before; Washington, D.C., is rapidly gentrifying. Meanwhile, places like Texas are absorbing more poor people, who are leaving places like California or New York. So I think we're seeing much more geographic segregation by income class.

I think there will be much larger numbers of people who live somewhat bohemian, [freelance] lifestyles, who culturally feel very upper-middle-class or even upper-class, but who don't have that much money. (Think of many parts of Brooklyn.) Those individuals will be financially precarious, but live happy, productive lives. How we evaluate that ethically is very tricky. Still, I think that's what we're going to see.

Wednesday November 6, 2013

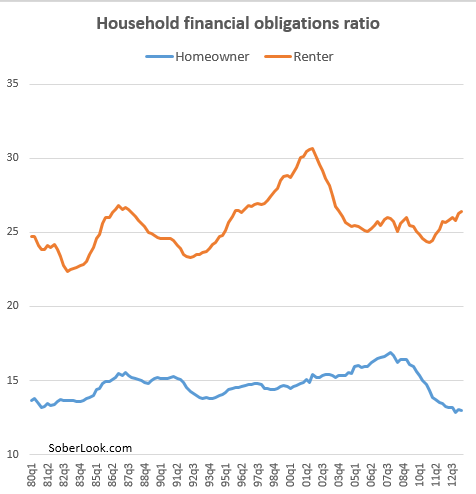

Monetary stimulus has helped homeowners more than its helped renters.

While homeowners have been able to reduce their monthly payments to the lowest level in decades via mortgage refinancing and cutting back on credit card usage, the FOR for renters has been on the rise.

Of course the most overburdened homeowners lost their homes and became renters which also brought down the financial obligations of aggregate homeowners.

Wednesday September 25, 2013

Ray Dalio's 30 minute explanation of the economy.

It's a pretty tidy formulation and probably a decent way to think of economic growth and the cycles along the way.

[ via ]

Friday September 6, 2013

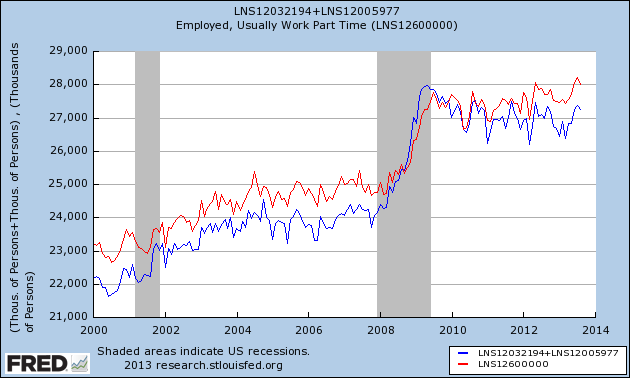

Part-time work accounts for the vast majority of this year's job growth.

So far this year there have been 848,000 new jobs. Of those, 813,000 are part time jobs... To put it differently, an incredible 96% of the jobs added this year were part-time jobs.

Update: This seems like a funny way to calculate things. If we're going to use the CPS data, why not use the reported full-time and part-time employment measures directly. By that accounting the fraction of jobs created this year that are part-time is 59%. Still high, but not quite as stunning.

Update 2: Here's the problem with John's calculation: Part-Time for Economic Reasons (LNS12032194) + Usually Work Part Time Noneconomic Reasons (LNS12005977) does not equal Total Part Time Workers (LNS12600000). To his credit, that's a little surprising to me too.

[ via ]

Thursday September 5, 2013

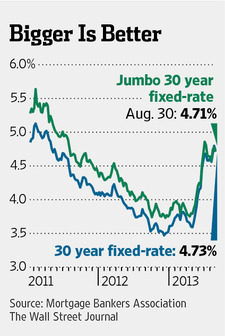

Mortgage market weirdness: Jumbo mortgage rates are lower than conventional mortgage rates.

A few folks have weighed in with explanations, but I'm not sure we have the whole story yet.

Thursday August 22, 2013

Although median annual household income rose to $52,100 in June, from its recent inflation-adjusted trough of $50,700 in August 2011, it remained $2,400 lower — a 4.4 percent decline — than in June 2009, when the recession ended. This drop, combined with the 1.8 percent decline that occurred during the recession, leaves median household income 6.1 percent — or $3,400 — below its level in December 2007, when the economic slump began.

See also here.

The ACS income data (and new rent data) I report will be released next month and we'll get to see how income has changed across the states and metro areas.

Monday July 29, 2013

Once again, increasing home prices is not the goal.

The goal of housing policy ought to be to bolster real living standards by making housing abundant and affordable without unduly siphoning resources off from other segments of the economy. If houses get cheaper, bigger, or better-located, that means real wages are rising — exactly what we want.

In fact, rising home prices have drawbacks for many.

Friday May 31, 2013

[QE] is definitely a pretty roundabout way of driving money into the real economy. Instead of putting the money directly to work, pay money to people who already have assets even more than their assets are currently trading for, in the hope that they'll put at least some of the money to work.

In a sidenote he addresses "helicopter money" AKA "QE for the people."

QE involves paying over a $ (or Pounds, or Yen) amount in return for an existing asset. This is a crucial feature, and accounts for many of the drawbacks — in particular that the policy benefits above all existing holders of assets. In theory, just handing money to everybody in the country is a more effective and equal way of acheiving its aims. But you don't have to be a hard-money Bundesbanker to be at least a little uncomfortable with where this might end up

QE via asset purchases does strike me as a very roundabout way of addressing a demand shortfall in a substantially consumer driven economy. But as the above post suggests, nothing else may be politically viable.

Wednesday May 29, 2013

Institutional home buying fatigue?

We just don't see the returns there that are adequate to incentivize us to continue to invest, [Bruce] Rose, 55, chief executive officer of Carrington Holding Co. LLC, said in an interview at his Aliso Viejo, California office. There's a lot of -- bluntly -- stupid money that jumped into the trade without any infrastructure, without any real capabilities and a kind of build-it-as-you-go mentality that we think is somewhat irresponsible.

[ via ]

Thursday February 28, 2013

The accelerating housing market?

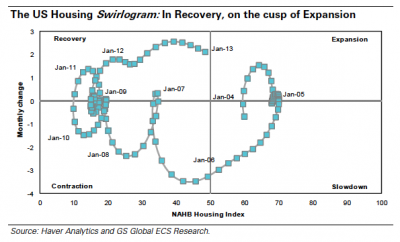

You don't see phase diagrams for housing everyday.